Are you feeling bullish on the bear market ? Maybe you think the S&P 500 is primed for a correction . If so, short selling might be a good idea. But with numerous choices like SDS and SPXU, how do you pick the right instrument to execute your bearish bet ? Let's dive into the nuts and bolts of these two popular securities .

- First , understand that both SDS and SPXU offer magnified returns when the S&P 500 falls . However, their approaches differ. SDS utilizes a traditional method , aiming to follow the inverse performance of the S&P 500 .

- On the other hand , SPXU utilizes a alternative strategy. It aims to multiply the inverse returns of the S&P 500 by a multiplier . This means that for every point the S&P 500 rises , SPXU aims to decline by a higher amount .

Finally, choosing between SDS and SPXU depends on your level of risk. While both offer access to short the S&P 500, their features differ significantly. Consider your trading goals and analyze both options thoroughly before making a decision.

Riding Market Downturns: SDS or SPXU? A Comparative Analysis

When market fluctuations escalate, savvy investors often seek strategies to mitigate potential losses. Two popular Exchange Traded Funds (ETFs) that aim to exploit declining markets are the ProShares Short S&P500 ETF (SDS) and the Direxion Daily S&P 500 Bear 3x Shares ETF (SPXU). Conversely, understanding their differences is crucial for making informed decisions. SDS offers a conventional approach by seeking to mirror the inverse performance of the S&P 500 index, while SPXU employs a more aggressive strategy with three times the daily exposure to the index's decline. This comparative analysis will delve into the benefits and disadvantages of both ETFs, providing investors with valuable insights to navigate market downturns effectively.

- Amplification: A key distinction between SDS and SPXU lies in their leverage. While SDS provides a 1x inverse exposure to the S&P 500, SPXU offers a 3x amplified effect. This possibility for magnified returns also comes with increased risk.

- Risk Profile: SPXU's higher leverage inherently increases its volatility compared to SDS. Investors should carefully consider their risk tolerance before allocating capital to SPXU.

- Fees: Both ETFs incur trading costs. It's essential to factor these expenses into the overall investment strategy as they can impact profitability.

This Low-Cost Trio for S&P 500 Exposure

What are the risks of investing in SDS or SPXU leveraged short ETFs?For investors seeking broad market exposure to the mighty S&P 500, there's a trio of low-cost funds that consistently excel: VOO, IVV, and SPLG. Each product tracks the S&P 500 index with remarkable accuracy, providing a simple and effective way to invest in the U.S. stock market's most influential companies.

- VOO, managed by Vanguard, is known for its ultra-low expense ratio, making it a go-to choice for long-term investors.

- IVV, from iShares, offers a similar structure with a slightly higher expense ratio but still remains incredibly budget-friendly.

- SPLG, also known for its low cost, provides an alternative option for investors seeking a slightly different approach.

When it comes to passive investing in the S&P 500, these three funds provide a compelling combination of low costs and broad market exposure.

Unlocking S&P 500 Upside: ETFs for Any Investor

The S&P 500, a benchmark of the top U.S. companies, offers ample potential for investors. However, navigating this complex market can be challenging for newbies. Thankfully, ETFs (Exchange Traded Funds) provide a versatile solution to access the S&P 500's performance, allowing investors of all experience levels to invest in this important market segment.

Whether you desire capital appreciation or want to reduce risk, there's an S&P 500 ETF suited to your goals.

From traditional index trackers to specialized ETFs that target particular industries within the S&P 500, there's a wide range of options available.

- Investigate the pros of passive investing with S&P 500 index ETFs.

- Consider actively managed ETFs that seek to surpass the benchmark.

- Spread your risk across multiple ETFs for a well-rounded portfolio.

Understanding the fundamentals of S&P 500 ETFs and thoughtfully selecting the right ones can empower you to maximize your investment outcome.

Navigating Bear Markets: Choosing the Right Short ETF (SDS vs SPXU)

When volatile market conditions appear, savvy investors seek alternative strategies to preserve their wealth. Short ETFs, which gain in value when the primary market falls, present a compelling option for leveraging on a bearish trend. Two prominent choices in this category are the ProShares UltraPro Short S&P500 ETF (SPXU) and the Direxion Daily S&P 500 Bear 3X Shares ETF (SDS). Both vehicles aim to enhance the daily inverse returns of the S&P 500 index, but their leverage differ significantly. SPXU implements a 3x leverage ratio, meaning it seeks to generate three times the daily inverse return of the S&P 500, while SDS offers a 3x leverage.

- Selecting the right ETF depends on your appetite and trading aspirations.

SPXU, with its higher magnification, can deliver substantial returns in a sharp downturn. However, it also renders investors to amplified volatility. SDS, on the other hand, while still offering significant participation, tends to be less volatile due to its more moderate amplification.

- Carefully analyze your financial strategy and risk before choosing between SDS and SPXU.

Remember, short ETFs can be powerful tools in a bear market, but they also carry considerable volatility. Meticulous research and a well-defined approach are crucial for navigating these complex instruments successfully.

Building Your Portfolio with VOO, IVV, and SPLG: A Guide to Core S&P 500 Investments

For those building their investment portfolios, the S&P 500 represents a cornerstone of long-term growth. Investing in this widely recognized index provides a balanced allocation and potential for consistent returns. Within this realm, Exchange Traded Funds (ETFs) like VOO, IVV, and SPLG have emerged as popular choices for individuals looking to invest.

VOO, the Vanguard S&P 500 ETF, stands out due to its low expense ratio, making it a favorite among value-oriented individuals investing in the market. IVV, iShares Core S&P 500 ETF, offers aligned tracking to VOO while providing versatility for investors seeking broader participation across various sectors. SPLG, SPDR® S&P 500 ETF Trust, distinguishes itself with its consistent results and potential for capital appreciation.

Ultimately, these three ETFs provide distinct advantages while serving a common purpose: to offer investors a simplified and effective way to gain access to the S&P 500. Before making any investment decisions, it's crucial to conduct thorough research, consider your individual financial goals, and consult with a qualified financial advisor.

Danny Tamberelli Then & Now!

Danny Tamberelli Then & Now! Rick Moranis Then & Now!

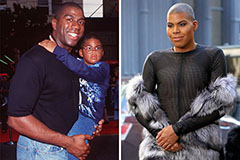

Rick Moranis Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!